Germany is one of the strongest economies in the world and has a solid tech industry. If you are planning on relocating to Germany, this post is for you. We have put together some useful information about work visa, taxes and financial facts.

After getting your German Work Visa, you can freely travel to Germany. However, there are still some procedures that you should complete upon arrival in Germany to obtain a German residence permit. The foreigners’ office will charge a fee to process a German residence permit application. The cost is usually somewhere between 50 and 110 euros (less for minors), depending on your case’s location and complexity. Let’s learn more about Germany’s Taxes, Financial Facts, Work Visa.

The first step after arriving in Germany with a work visa

You should go to the Foreigner’s Office in Germany, located nearest to your place of residence. Some offices require you to make an appointment before your interview, while others accept walk-in applications.

You will need to attend an interview during which you will also submit the required documents for a residence permit. These documents are:

- Your nationally valid passport

- Application form for a Residence Permit

- Two photos

- Report of a clean criminal record

- Proof of German Language*

- Health Insurance Confirmation

- Proof of Job Offer

*Obtaining a work visa in Germany does not require German language proficiency. However, some German companies may require proof of a particular level of German knowledge to work for them and complete the work visa application process (this entirely depends on the company).

Your employment contract determines the period you are allowed to hold your permit. If your contract is for two years, your visa will also be valid for two years. However, you can extend it as many times as you need as long as you maintain your employment status.

Learn more about Taxes in Germany

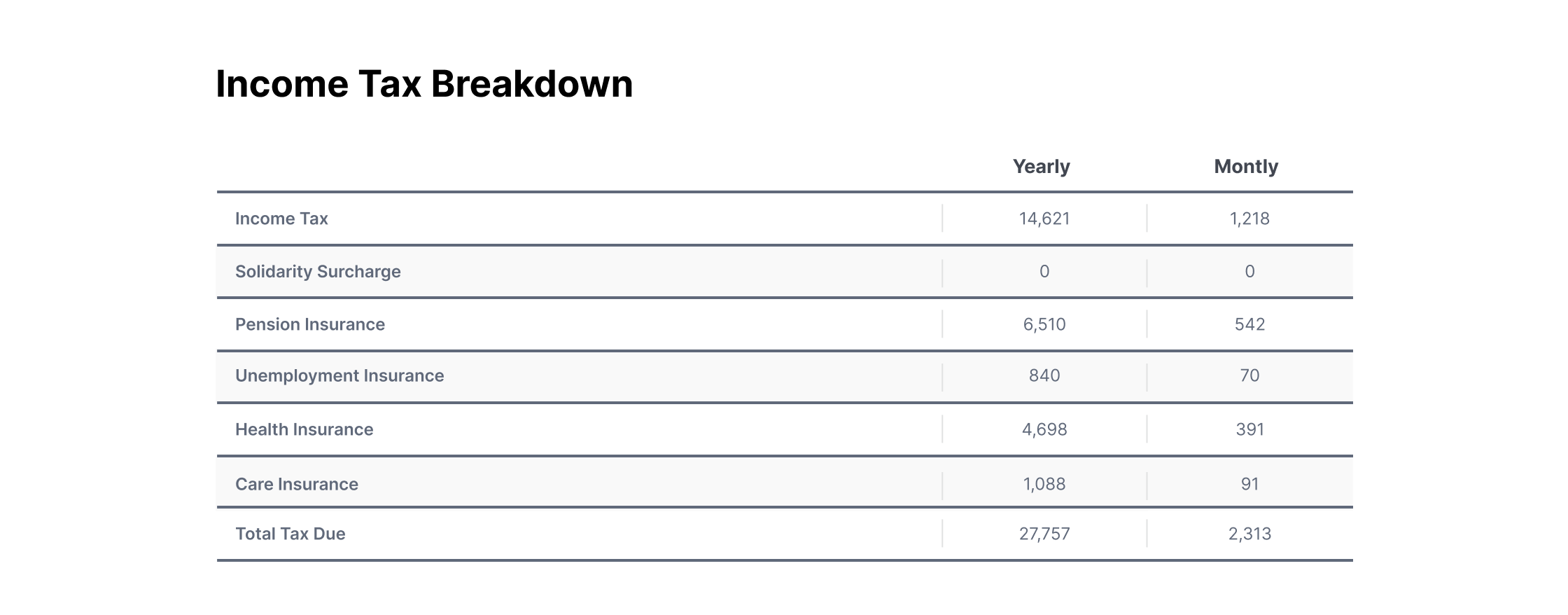

We put together a simplified list of taxes collected in Germany. This way, you can understand a bit about these financial obligations and plan for your relocation:

Income Tax: is a progressive tax, meaning that individuals with higher wages will be taxed more than individuals with lower salaries. The basic personal allowance is currently 9 984 EUR, an amount exempt from income tax.

Solidarity Surcharge: is a tax levied in an attempt to provide funding for socially unifying activities or projects. If your income tax is more than 16 956 euros per year, the solidarity surcharge rate is 5.5% of your income tax.

Pension Insurance: is a social security tax representing 9.3% of your income.

Unemployment Insurance: is a social security tax, representing 1.2% of your income.

Health Insurance: is a social security tax, and it represents up to 7.3% of your income.

Care Insurance: is a social security tax, and it represents between 1.875% and 2.375% of your income, depending on the federal state.

Tax Rates: Income tax in Germany is progressive, starting at 1% and rising incrementally to 42% or, for very high incomes, 45%. The tax rate of 42% applies to taxable income between €58,597 to 277,825 for 202

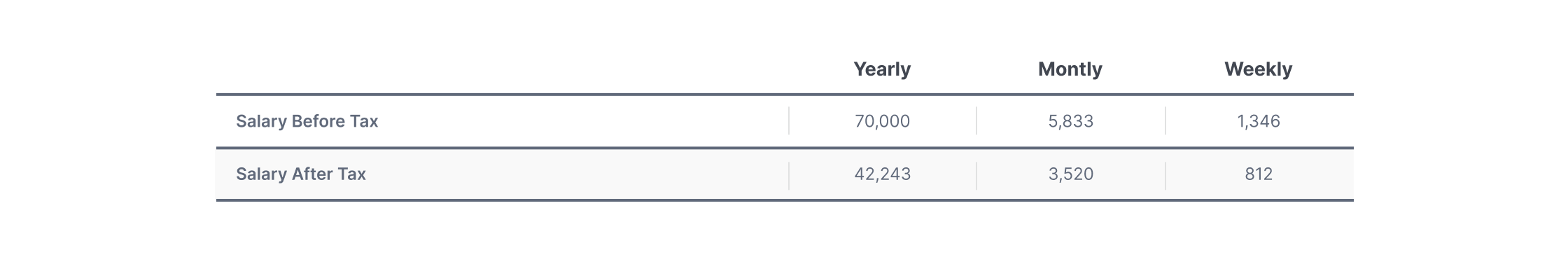

For example, on a 70.000 €, the breakdown is ↓

This is what a detailed simulation would look like:

The Total Tax Due is the sum of all taxes and contributions deducted from your gross salary.

The deductions used in the calculator assume you are not married and have no dependents. You may pay less if tax credits or other deductions apply.

Financial Facts About Germany

Germany’s average monthly net salary is around 2 400 EUR, with a minimum income of 1 100 EUR per month. These figures place Germany in 12th place in the list of European countries by average wage. Germany is not considered expensive compared to other European countries, the prices of food and housing being only slightly higher than the EU average. The country performs very well in many measures of well-being, ranking above the average in education, work-life balance, jobs, income, environmental quality, health, civic engagement, housing, and personal security.

Germany possesses one of the largest economies in the world and employs a social market economy. It has the largest national economy in Europe, the fourth-largest by nominal GDP globally, and the fifth by GDP. Germany has consistently been at the forefront of industrial leadership. The most significant German industries are automotive, electrical engineering, transport, general engineering, mechanics, precision optics, and pharmaceutics.

Germany is open to immigration, being the second most popular immigration destination globally after the United States. According to The Independent, three out of the ten best cities for quality of living are in Germany: Munich, Dusseldorf, and Frankfurt.

Useful links:

How to get a German Residence Permit

Check the cost of living in different countries

Learn more about work visas in Germany

Get more information about taxation in Germany

Level of German needed for a visa in Germany

..

🌎 VANHACK, LinkedIn Talent Awards Winner 2021, is Canada’s most respected recruitment company. With more than 1,500 hires, VanHack is on a mission of increasing diversity and creating a borderless world. So if you are a software developer looking for a job abroad, in Canada, the US, or Europe, join VanHack today. 100% free for candidates, plus you will get all the preparation you need when your profile is shortlisted.

Visit our platform to become one of our many VanHackers hired abroad 😃

For success stories and tips about working in Canada, check out the VanHack Podcast 🎧

Be part of VanHack’s Learning Hub 📒

Check out the next VanHack event 🗓