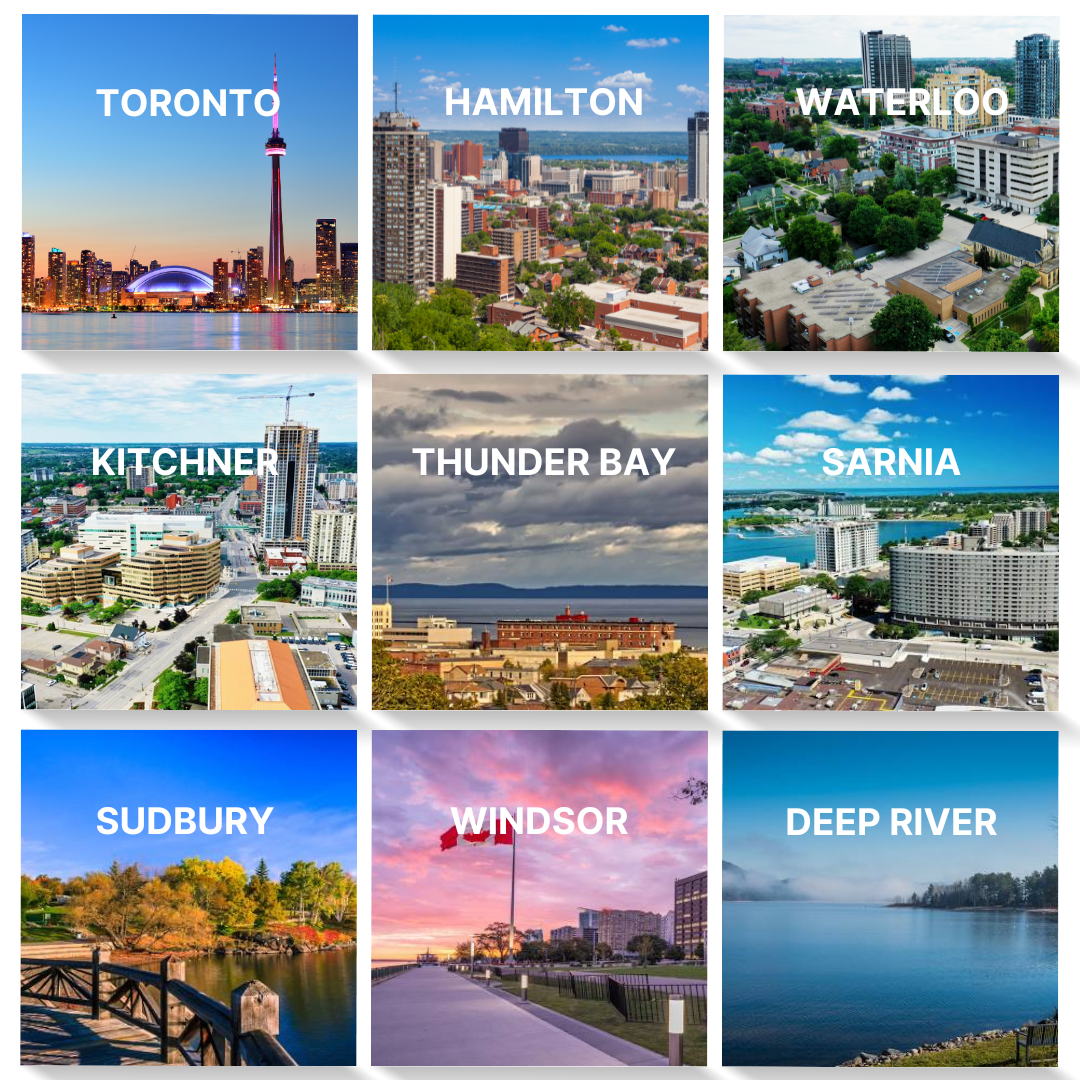

Ontario is a province in east-central Canada that borders the U.S. and the Great Lakes. It’s home to Ottawa, Canada’s capital, known for Parliament Hill’s Victorian architecture and the National Gallery, featuring Canadian and indigenous art.

The province is renowned for being one of the most diverse regions in Canada, boasting stunning cities and landscapes, as well as a thriving job market. Cities like Waterloo and Kitchener are integral to what is known as Ontario’s tech hub. However, like any other place in the world, it comes with a price tag.

💰How expensive is it to live in Ontario, Canada?

The cost of living in Ontario varies depending on factors like location and personal preferences.

According to recent data from a new study by Westland Insurance, “It’s no surprise that living in Ontario costs more than in other parts of Canada. According to the seven weighted factors — which include the median income in various locations — Ontario is almost a whopping four times pricier for residents than the nation’s cheapest province, Newfoundland and Labrador.”Key considerations include when relocating to Ontario, CA:

- Exchange Rate: Understand the strength of your home currency relative to the Canadian dollar.

- City and Region: Understand the costs differ between cities, with major ones being more expensive.

- Food prices: Understand the cost depends on location but mainly your lifestyle.

- Transportation: Understand costs for public transit (gasoline and car ownership vary).

- Taxes: Understand Canada’s progressive tax system (higher earners pay more).

- Education: Understand public schools are free, but private and higher education can be costly.

The Currency

Given that you have a job in Canada that pays you in Canadian dollars, you’ll soon accumulate a significant amount of CAD in your bank account. However, as a newcomer to Canada, it’s crucial to grasp the significance and purchasing power of this currency.

The list below shows the approximate value of Canadian dollars at the time of writing (October, 5, 2023), compared to a few major currencies:

- $1000 USD = CAD 1355

- £1000 GBP = CAD 1670

- €1000 EUR = CAD 1427

- A$1000 AUD = CAD 872

City & Region

The following chart is from MovingWaldo website, where they share the cheapest cities in Ontario, according to their experience and data.

Based on this graphic, we’ve put together the price for 1 bed and 2 bed condo (rental monthly rate) for each of the cities above and also added Toronto, Mississauga, Markham and Hamilton for comparison.

|

City & <distance |

1 bed condo/ monthly rate |

2 bed condo/ monthly rate |

Other costs for 1 person (besides rent) |

| Toronto | $2,100 | $3,300 | $900 |

| Mississauga <27.7 km> | $2,100 | $3,200 | $900 |

| Markham <29.8 km> | $1,990 | $3,000 | $900 |

| Hamilton <68 km> | $1,800 | $2,800 | $900 |

| Thunder Bay <1,400km> | $1,315 | $1,600 | $900 |

| Rainy River <1,770 km> | $1,000 | $1,600 | $900 |

| Deep River <415 km> | $1,400 | $1,600 | $900 |

| Sudbury <403 km> | $1,200 | $1,600 | $900 |

| Sarnia <293 km> | $1,475 | $1,800 | $900 |

| Kingston <263.5 km> | $1,700 | $1,899 | $900 |

| Windsor <372 km> | $1,500 | $1,685 | $900 |

| London <195 km> | $1,345 | $2,119 | $900 |

| Peterborough <139 km> | $1,875 | $2,800 | $900 |

| Barrie <112.2 km> | $2,000 | $2,600 | $900 |

| Waterloo <113 km> | $1,600 | $2,000 | $900 |

| Kitchener <107 km> | $1,700 | $2,100 |

$900 |

⚠️ Affordability can vary depending on housing costs, job opportunities, and personal circumstances. It’s important to conduct your own research and consider your needs and preferences when choosing a place to live in Ontario.

** Other costs such as grocery, electricity, internet.

Consider adding tenant insurance cost on top of your rent:

In Ontario, tenant insurance for a one-bedroom apartment typically ranges from CAD 150 to CAD 360. These costs can vary based on factors such as coverage, location, and the age of the building.

Taxes

Here are the approximate tax rates for Federal and Ontario rates.

Plese, use a tax calculator for more details.

- Federal Income Tax rates range from 15% to 33% on various income levels.

|

Federal tax bracket |

Federal tax rates |

|

$50,197 or less |

15.00% |

|

$50,198 to $100,392 |

20.50% |

|

$100,393 to $155,625 |

26.00% |

|

$155,626 to $221,708 |

29.00% |

|

more than $221,708 |

33.00% |

-

Provincial Income Tax rates range from 5% to 13.16% on various income levels.

|

Ontario tax bracket |

Ontario tax rates |

|

$46,226 or less |

5.05% |

|

$46,227 to $92,454 |

9.15% |

|

$92,455 to $150,000 |

11.16% |

|

$150,001 to $220,000 |

12.16% |

|

more than $220,000 |

13.16% |

-

Federal & Provincial Taxes considering annual salaries of CAD 60k, CAD 70k, CAD 80k, CAD 90k:

|

Annual Gross Income |

Federal |

Provincial Tax |

CPP/EI Premiums |

Estimated Net Salary |

|

CAD 60,000 |

CAD 6,538 |

CAD 3,404 |

CAD 4,169 |

CAD 45,889 |

|

CAD 70,000 |

CAD 8,543 |

CAD 4,303 |

CAD 4,453 |

CAD 52,701 |

|

CAD 80,000 |

CAD 10,593 |

CAD 5,368 |

CAD 4,453 |

CAD 59,586 |

|

CAD 90,000 |

CAD 12,643 |

CAD 6,392 |

CAD 4,453 |

CAD 66,512 |

Goods and Services Tax (GST): The federal GST rate is 13%. This tax is applied to most goods and services.

Education

If you have children, you’ll want to factor in the cost of education. Ontario offers both public and private school options, with tuition fees for private schools being significantly higher. Post-secondary education costs, including tuition and textbooks, can also be a significant financial burden for students and their families.

The cost of childcare in Ontario can vary significantly based on several factors, including the type of childcare, the age of the child, the location, and whether the facility is licensed or not. Here’s a general overview of the types of childcare and their potential costs:

Licensed Childcare Centers: Licensed childcare centers in Ontario often have a range of fees based on the age of the child and the specific center’s policies. On average, you can expect to pay around:

-

Infant care (0-18 months): $1,500 to $2,000 per month.

-

Toddler care (18 months to 2.5 years): $1,200 to $1,800 per month.

-

Preschool care (2.5 to 4 years): $1,000 to $1,500 per month.

These figures can vary significantly based on the region. For example, childcare in larger cities like Toronto or Ottawa may be more expensive than in smaller towns.

Home-Based Daycares: Home-based daycares, or family daycares, are often more affordable than licensed centers. Monthly costs can range from $800 to $1,400, depending on the age of the child and the specific provider’s rates.

Preschool Programs: Preschool programs, which focus more on early education and may not offer full-day care, can range from $100 to $500 per month. These programs typically cater to children aged 2.5 to 4 years.

Full-Day Kindergarten (Ages 4 and Up): In Ontario, full-day kindergarten is part of the public education system and is free for children aged 4 and up. Parents do not have to pay for this program.

Elementary School (Ages 6 to 13): Education in publicly funded elementary schools is free for children from the age of 6 (Grade 1) through the age of 13 (Grade 8). The government provides funding for primary and middle school education.

High School (Ages 14 to 18): Public high school education in Ontario is free for students from the age of 14 (Grade 9) through the age of 18 (Grade 12). High school education is compulsory until the age of 18, and it is publicly funded.

💰Cost of Living in Ontario

Everybody has a different standard when it comes to being financially comfortable. It also depends on where you live in Ontario, CA.

To help you understand the cost of living, we’ve put together the cost for a single person living in ON, considering average prices. Please note that this is a rough estimate, as individual circumstances and deductions can affect the final net salary amount:

💁One single person | 1 bed = CAD ~33,810

Rent: CAD ~1,500 x 12 = CAD 18,000

Tenant Insurance: CAD ~150

Grocery/Utilities: CAD ~900 x 12 = CAD 10,800

Transportation: CAD ~105 x 12 = CAD 1,260

Entertainment (dining out/shopping/others): CAD ~300 x 12 = CAD 3,600

Gas: N/A

Medical Services in ON: N/A

Other health/insurance costs may be under your employment agreement.

Please, add other costs as needed.

The total annual expenses are CAD ~33,810.

💁💁One couple (2 adults) | 1 bed = CAD ~44,070.

Rent: CAD ~1,500 x 12 = CAD 18,000

Tenant Insurance: CAD ~150

Grocery/Utilities: CAD ~1,350 x 12 = CAD 16,200

Transportation: CAD ~210 x 12 = CAD 2,520

Entertainment (dining out/shopping/others): CAD ~600 x 12 = CAD 7,200

Gas: N/A

Medical Services in ON: N/A

Other health/insurance costs may be under your employment agreement.

Please, add other costs as needed.

The total annual expenses are CAD ~44,070.

⚠️Factoring in both federal and provincial taxes, take a look at the estimated net salary:

|

Annual Gross Income (CAD) |

Estimated Net Salary |

|

CAD 60,000 |

CAD 45,889 |

|

CAD 70,000 |

CAD 52,701 |

|

CAD 80,000 |

CAD 59,586 |

|

CAD 90,000 |

CAD 66,512 |

💁💁🍼One couple (2 adults + One kid under 5 years old) = CAD ~75,720

Rent: CAD ~2,000 x 12 = CAD 24,000

Grocery/Utilities: CAD ~1,800 x 12 = CAD 21,600

Transportation: CAD ~210 x 12 = CAD 2,520

Entertainment (dining out/shopping/others): CAD ~900 x 12 = CAD 10,800

Daycare: CAD ~1,400 x 12 = CAD 16,800

Gas: N/A

Medical Services in ON: N/A

Other health/insurance costs may be under your employment agreement.

Please, add other costs as needed.

The total annual expenses are CAD ~75,720

⚠️Each month, eligible families with children under the age of 18 receive the benefit payment as a combined payment with the Canada child benefit. Eligibility depends on family income.

⚠️Medical Services: Accompanying spouses and children of eligible work and study permits may be deemed eligible for OHIP under the Medical and Health Care Services Regulation if they hold a valid visitor permit.

The information provided in this blog regarding the cost of living in Ontario is intended for general reference purposes only. It is essential to note that the cost of living can vary significantly based on individual circumstances, economic factors, and changing market conditions. The figures and data presented here are subject to change, and they may not reflect the most current or accurate information at the time of your reading.

For the most current and accurate information on costs in Ontario, we recommend visiting the official websites of relevant government agencies, local municipalities, and reputable sources that specialize in cost-of-living data. Additionally, conducting your own research and considering your unique personal circumstances, such as family size, lifestyle choices, and location within Ontario, is crucial when assessing your specific cost of living.

This blog is intended to serve as a starting point for individuals considering a move to Ontario or seeking a general overview of living expenses in the region. However, it should not be relied upon as the sole source of information for financial planning or decision-making. We encourage readers to use this information as part of a more comprehensive analysis and planning process when considering changes in their living situation, especially when moving between countries or regions.

Relocate to Canada With VanHack

VanHack is your gateway to a world of exceptional job opportunities and exciting prospects.

Here’s how VH can help you make Canada your home:

📌 Job Board: VanHack’s job board is your one-stop destination for a wide array of job openings in Canada and other parts of the globe. Most of the job postings offer sponsored visas, making your international job search a breeze. Plus, we’ve carefully curated our hiring partners to ensure you’ll be working with some of the best companies out there. Secure your job in Canada and relocate with peace of mind: VanHack.com/Jobs.

🏢 Canadian Engineer Office: Maybe you’re already in a fulfilling role with your current employer, but they don’t have an office in Canada. No worries! With VanHack, you can join our Canadian Engineer Office program and enjoy all the benefits of being part of an international team. This option offers you the best of both worlds—staying with a company you love and experiencing the perks of working in Canada. Discover if you are eligible: VanHack.com/MoveToCanada.

Other Sources/Resources: