Universal healthcare, a progressive government, a diverse range of natural landscapes that cater to the interests of outdoor enthusiasts, photographers, and city dwellers alike, make Canada an appealing destination for people worldwide.

If you’re one of those individuals who would love to move to Canada, one of your initial tasks will be to determine the expenses associated with the move and the ongoing cost of living in the country.

This comprehensive guide will provide you with some of the essential information about the cost of living specifically in British Columbia (one of the most beautiful Canada’s destinations), ensuring that you are well-prepared to begin your new and promising chapter in this country.

💰How expensive is it to live in British Columbia, Canada?

The cost of living in BC varies depending on factors like location and personal preferences.

Key considerations include when relocating to BC, CA:

- Exchange Rate: Understand the strength of your home currency relative to the Canadian dollar.

- City and Region: Understand the costs differ between cities, with major ones being more expensive.

- Food prices: Understand the cost depends on location but mainly your lifestyle.

- Transportation: Understand costs for public transit (gasoline and car ownership vary).

- Taxes: Understand Canada’s progressive tax system (higher earners pay more).

- Education: Understand public schools are free, but private and higher education can be costly.

The currency

Given that you have a job in Canada that pays you in Canadian dollars, you’ll soon accumulate a significant amount of CAD in your bank account. However, as a newcomer to Canada, it’s crucial to grasp the significance and purchasing power of this currency.

The list below shows the approximate value of Canadian dollars at the time of writing (October, 5, 2023), compared to a few major currencies:

- $1000 USD = CAD 1355

- £1000 GBP = CAD 1670

- €1000 EUR = CAD 1427

- A$1000 AUD = CAD 872

City and Region & Food

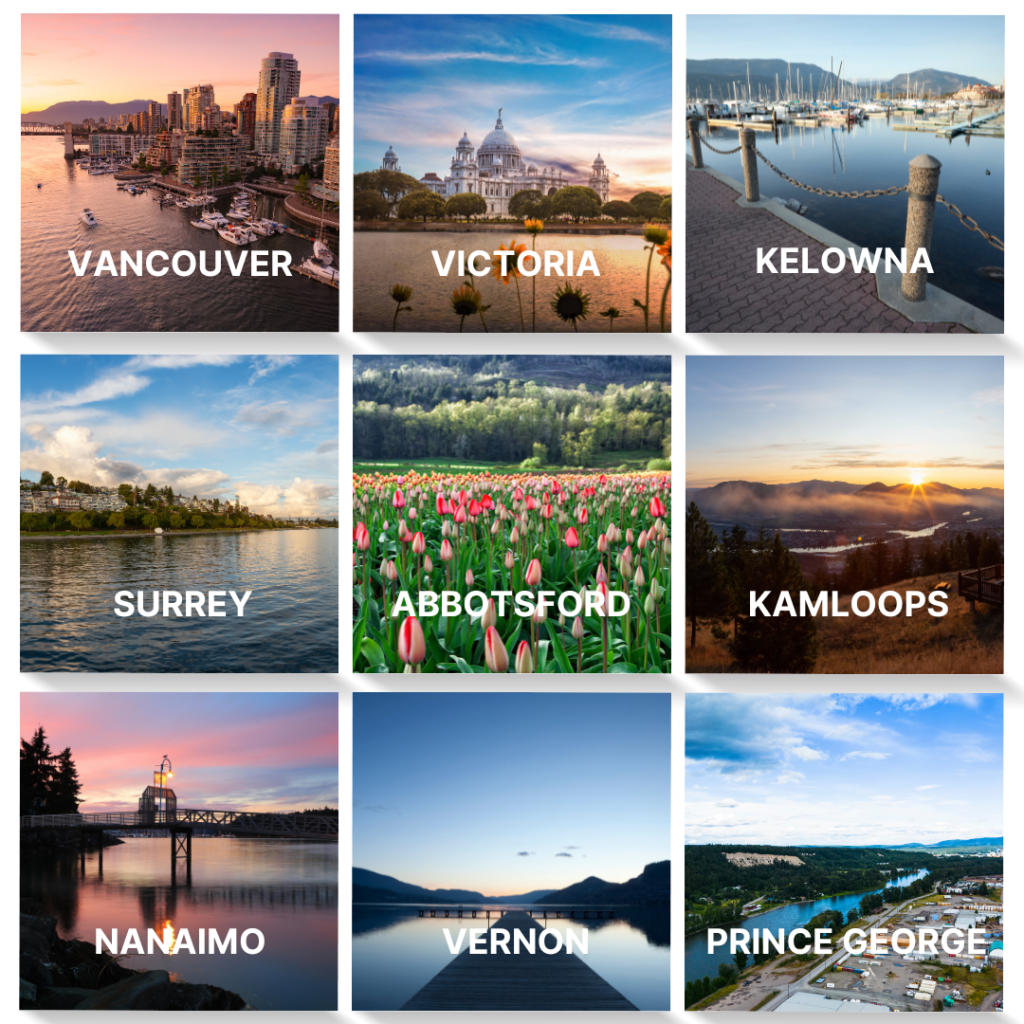

The following chart shares some basic costs across BC in what we’ve found to be some most affordable* cities in the province – adding Vancouver, Victoria and Kelowna for reference.

🔵 Click on the name of the city to find out more about it.

|

City & <distance from Vancouver, BC> |

1 bed condo/

monthly rate |

2 bed condo/

monthly rate |

Grocery for 1** |

| Vancouver | ~ CAD 2600 | ~ CAD 4000 | ~ CAD 450 |

| Victoria <70km> | ~ CAD 2100 | ~ CAD 2600 | ~ CAD 450 |

| Kelowna <390> | ~ CAD 2000 | ~ CAD 2300 | ~ CAD 450 |

| Surrey <30km> | ~ CAD 1800 | ~ CAD 2500 | ~ CAD 450 |

| Abbotsford <70km> | ~ CAD 1500 | ~ CAD 2000 | ~ CAD 450 |

| Kamloops <355km> | ~ CAD 1400 | ~ CAD 1800 | ~ CAD 450 |

| Nanaimo <110km> | ~ CAD 1400 | ~ CAD 1800 | ~ CAD 450 |

| Vernon <390> | ~ CAD 1400 | ~ CAD 1800 | ~ CAD 450 |

| Prince George <780km> | ~ CAD 1100 | ~ CAD 1400 | ~ CAD 450 |

You may want to take a look at other cities, such as Terrace, Greenwood, Golden, Fort Nelson.

⚠️ There are different lists out there related to the ‘most affordable cities to live’, that being said we have put together some of the lowest ones. Affordability can vary depending on housing costs, job opportunities, and personal circumstances. It’s important to conduct your own research and consider your needs and preferences when choosing a place to live in British Columbia.

* Rental prices: https://www.kijiji.ca/ & Vancouver Rental Market Stats

** Grocery prices: While Canada’s Food Price Report displays an average grocery cost of CAD 360 for a single person, our recent experiences indicate that the actual cost is closer to CAD 450.

Consider adding tenant insurance cost on top of your rent: In Vancouver, tenant insurance for a one-bedroom apartment typically ranges from CAD 150 to CAD 300 annually, while for a two-bedroom apartment, it ranges from CAD 200 to CAD 400. These costs can vary based on factors such as coverage, location, and the age of the building.

Transportation

Transportation cost may vary depending on the city you live in, in Metro Vancouver the average cost is CAD 105 per month, while in some of the cities above, such as Kamloops it can be around CAD 55 per month.

Taxes

Here are the approximate tax rates for Federal and British Columbia rates.

Plese, use a tax calculator for more details.

- Federal Income Tax rates range from 15% to 33% on various income levels.

|

Federal tax bracket |

Federal tax rates |

|

CAD 50,197 or less |

15.00% |

|

CAD 50,198 to 100,392 |

20.50% |

|

CAD 100,393 to 155,625 |

26.00% |

|

CAD 155,626 to CAD 221,708 |

29.00% |

|

more than CAD 221,708 |

33.00% |

|

British Columbia tax bracket |

British Columbia tax rates |

|

CAD 43,070 or less |

5.06% |

|

CAD 43,071 to 86,141 |

7.70% |

|

CAD 86,142 to 98,901 |

10.50% |

|

CAD 98,902 to 120,094 |

12.29% |

|

CAD 120,095 to 162,832 |

14.70% |

|

CAD 162,833 to 227,091 |

16.80% |

|

more than CAD 227,091 |

20.50% |

- Federal & Provincial Taxes considering annual salaries of CAD 60k, CAD 70k, CAD 80k, CAD 90k:

| Annual Gross Income | Federal Tax |

Provincial Tax | CPP/EI Premiums | Estimated Net Salary |

| CAD 60,000 | CAD 6,538 | CAD 2,689 | CAD 4,169 | CAD 46,605 |

| CAD 70,000 | CAD 8,543 | CAD 3,444 | CAD 4,453 | CAD 53,561 |

| CAD 80,000 | CAD 10,593 | CAD 4,214 | CAD 4,453 | CAD 60,741 |

| CAD 90,000 | CAD 12,643 | CAD 5,079 | CAD 4,453 | CAD 67,825 |

- Goods and Services Tax (GST): The federal GST rate is 5%. This tax is applied to most goods and services, but some essential items may be exempt or zero-rated (taxed at 0%).

Education

Canadians enjoy a free public school system for children from 5 up to age 18. For higher education, prices in Canada are relatively low compared to universities in the US, UK and Australia.

As an example, the well known University of British Columbia (UBC) offers the 12 month full year program tuition fees for 2024 at: C$31,634.73 for the 12 month full-time program or C$10,544.91 per installment for Canadian citizens and permanent residents of Canada. C$61,743.57 for the 12 month full-time program or C$20,581.19 per installment for international students.

In British Columbia, private daycare services for children under 5 years old are available to parents who need childcare while they work or attend other activities. The price for full-time daycare (Monday to Friday) can vary widely depending on several factors, including the location, the quality of the facility, and the age of the child. Here are some key points to consider:

The government of British Columbia provides subsidies to help lower-income families with the cost of childcare. Eligibility for these subsidies depends on family income and other factors.

The average cost for full-time daycare (Monday to Friday) for a child under 5 years old in British Columbia could range from approximately $800 to $1,500 per month, with higher costs in major cities and lower costs in rural areas.

💰Cost of Living in Beautiful BC

Everybody has a different standard when it comes to being financially comfortable. It also depends on where you live in British Columbia, CA.

In general, a single person living in British Columbia might need an income of at least CAD 45,000 to CAD 70,000 per year to cover basic living expenses comfortably.

To help you understand the cost of living, we’ve put together the cost for a single person living in BC, considering average prices. Please note that this is a rough estimate, as individual circumstances and deductions can affect the final net salary amount:

💁One single person | 1 bed = CAD 31,410

Rent: CAD ~1,500 x 12 = CAD 18,000

Tenant Insurance: CAD ~150

Grocery: CAD ~450 x 12 = CAD 5,400

Transportation: CAD ~105 x 12 = CAD 1,260

Utilities (heat/internet/mobile): CAD ~250 x 12 = CAD 3,000

Entertainment (dining out/shopping/others): CAD ~300 x 12 = CAD 3,600

Gas: N/A

Medical Services Plan (MSP) in BC: N/A

Other health/insurance costs may be under your employment agreement.

Please, add other costs as needed.

CAD 18,000 (Rent) + CAD 150 (Tenant Insurance) + CAD 5,400 (Grocery) + CAD 1,260 (Transportation) + CAD 3,000 (Utilities) + CAD 3,600 (Entertainment) = CAD 31,410

The total annual expenses are CAD ~31,410.

🫶🏽 VanSweetHome can help you find your rental before you arrive in Canada.

Check it out.

💁💁One couple (2 adults) | 1 bed = CAD 41,790

Rent: CAD ~1,500 x 12 = CAD 18,000

Tenant Insurance: CAD ~150

Grocery: CAD ~450 x 12 + (CAD ~360* x 12) = CAD 9,720

Transportation: CAD ~210 x 12 = CAD 2,520

Utilities (heat/internet/mobile): CAD ~350 x 12 = CAD 4,200

Entertainment (dining out/shopping/others): CAD ~600 x 12 = CAD 7,200

Gas: N/A

Medical Services Plan (MSP) in BC: N/A

Other health/insurance costs may be under your employment agreement.

Please, add other costs as needed.

*Groceries for the second person we are considering the actual data from Canada’s Food Price Report.

CAD 18,000 (Rent) + CAD 9,720 (Grocery) + CAD 2,520 (Transportation) + CAD 4,200 (Utilities) + CAD 7,200 (Entertainment) = CAD 41,790

The total annual expenses are CAD ~41,790.

⚠️Factoring in both federal and provincial taxes, take a look at the estimated net salary:

| Annual Gross Income (CAD) | Estimated Net Salary |

| CAD 60,000 | CAD 46,605 |

| CAD 70,000 | CAD 53,561 |

| CAD 80,000 | CAD 60,741 |

| CAD 90,000 | CAD 67,825 |

💁💁🍼One couple (2 adults + One kid under 5 years old)

Rent: CAD ~2,000 x 12 = CAD 24,000

Grocery: CAD ~450 x 12 + 2 x (CAD 360 x 12) = CAD 14,040

Transportation: CAD ~210 x 12 = CAD 2,520

Utilities (heat/internet/mobile): CAD ~400 x 12 = CAD 4,800

Entertainment (dining out/shopping/others): CAD ~900 x 12 = CAD 10,800

Daycare: CAD ~1,150 x 12 = CAD 13,800

Gas: N/A

Medical Services Plan (MSP) in BC: N/A

Other health/insurance costs may be under your employment agreement.

Please, add other costs as needed.

CAD 24,000 (Rent) + CAD 14,040 (Grocery) + CAD 2,520 (Transportation) + CAD 4,800 (Utilities) + CAD 10,800 (Entertainment) + CAD 13,800 (Daycare) = CAD 70,960 per year.

The total annual expenses are CAD ~70,960.

⚠️Each month, eligible families with children under the age of 18 receive the benefit payment as a combined payment with the Canada child benefit. Eligibility depends on family income.

⚠️Medical Services Plan (MSP): Accompanying spouses and children of eligible work and study permits may be deemed eligible for MSP under the Medical and Health Care Services Regulation if they hold a valid visitor permit.

The information provided in this blog regarding the cost of living in BC is intended for general reference purposes only. It is essential to note that the cost of living can vary significantly based on individual circumstances, economic factors, and changing market conditions. The figures and data presented here are subject to change, and they may not reflect the most current or accurate information at the time of your reading.

For the most current and accurate information on costs in BC, we recommend visiting the official websites of relevant government agencies, local municipalities, and reputable sources that specialize in cost-of-living data. Additionally, conducting your own research and considering your unique personal circumstances, such as family size, lifestyle choices, and location within BC, is crucial when assessing your specific cost of living.

This blog is intended to serve as a starting point for individuals considering a move to BC or seeking a general overview of living expenses in the region. However, it should not be relied upon as the sole source of information for financial planning or decision-making. We encourage readers to use this information as part of a more comprehensive analysis and planning process when considering changes in their living situation, especially when moving between countries or regions.

Relocate to Canada With VanHack

VanHack is your gateway to a world of exceptional job opportunities and exciting prospects.

Here’s how VH can help you make Canada your home:

📌 Job Board: VanHack’s job board is your one-stop destination for a wide array of job openings in Canada and other parts of the globe. Most of the job postings offer sponsored visas, making your international job search a breeze. Plus, we’ve carefully curated our hiring partners to ensure you’ll be working with some of the best companies out there. Secure your job in Canada and relocate with peace of mind: VanHack.com/Jobs.

🏢 Canadian Engineer Office: Maybe you’re already in a fulfilling role with your current employer, but they don’t have an office in Canada. No worries! With VanHack, you can join our Canadian Engineer Office program and enjoy all the benefits of being part of an international team. This option offers you the best of both worlds—staying with a company you love and experiencing the perks of working in Canada. Discover if you are eligible: VanHack.com/MoveToCanada.

Other Sources/Resources:

- VanHack Canadian Engineer Office

- Benefits With Canadian Engineer Office

- Eligibility to Employment Insurance

- Visa Types & Process: Understanding ‘Closed Work Permits’ and What Happens When Terminating a Contract with Your Canadian Employer

- Canada Health Care System & Provincial Medical Services Plan

- Modes of transportation for commuting in Canada in 2022

- Cost of Living in Canada

- Cost of Living in Vancouver

…